Hello,

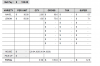

I am under a WHV (subclass 417) and i started farm work (specified to get a second year visa) a few weeks ago. I noticed that there is no tax on my pay slips. So i asked my manager and he says it is normal for the TFN declaration i have signed. I asked him a picture of it, and it shows that i signed as an Australian resident claiming tax free. (I had no choice, it was printed with this already checked. Everyone working here is in working holiday as well...)

What should i do? Should i pay my taxes by asking for the tax refund?

I am under a WHV (subclass 417) and i started farm work (specified to get a second year visa) a few weeks ago. I noticed that there is no tax on my pay slips. So i asked my manager and he says it is normal for the TFN declaration i have signed. I asked him a picture of it, and it shows that i signed as an Australian resident claiming tax free. (I had no choice, it was printed with this already checked. Everyone working here is in working holiday as well...)

What should i do? Should i pay my taxes by asking for the tax refund?